Full Overview

Trading Philosophy

The High-End Indicators & Backtesting system offers both trend-following and mean-reversal algorithms to provide traders with a deep insight into the highly volatile cryptocurrency markets, known for their market noise and vulnerability to manipulation.

With these factors in mind, our indicators are designed to sidestep most potentially false signals. This is facilitated further by the "middle-ground" time frame (1 Hour) we use. Our focus is on the two largest cryptocurrencies: Bitcoin and Ethereum, which are less susceptible to manipulation and provide high liquidity, necessary for reliable trading.

Therefore, we recommend using our suite on these markets.

The backtesting version of the Sofex High-End Indicators includes mainly trend-following indicators. This is because our trading vision is that volatility in cryptocurrency markets is a tool that should be used carefully, and many times avoided. Furthermore, mean-reversal trading can lead to short-term profits, but we have found it less than ideal for long-term trading.

The script does not aim to make a lot of trades, or to always remain in a position and switch from long to short. Many times there is no direction and the market is in "random walk mode", and chasing trades is futile.

Based on our experience, it is preferable if traders remain neutral the majority of the time and only enter trades that can be exited in the foreseeable future. Trading just for the sake of it ultimately leads to loss in the long-run. Expectations of performance should be realistic.

We also focus on a balanced take-profit to stop-loss ratio. In the default set-up of the script, that is 2% : 2% (1:1) ratio. A relatively low stop loss and take profit build onto our idea that positions should be exited promptly. There are many options to edit these values, including enabling trailing take profit and stop loss. Traders can also completely turn off TP and SL levels, and rely on opposing signals to exit and enter new trades.

Extreme scenarios can happen on the cryptocurrency markets, and disabling stop-loss levels completely is not recommended. The position size should be monitored since all of it is at risk with no stop-loss.

Indicators

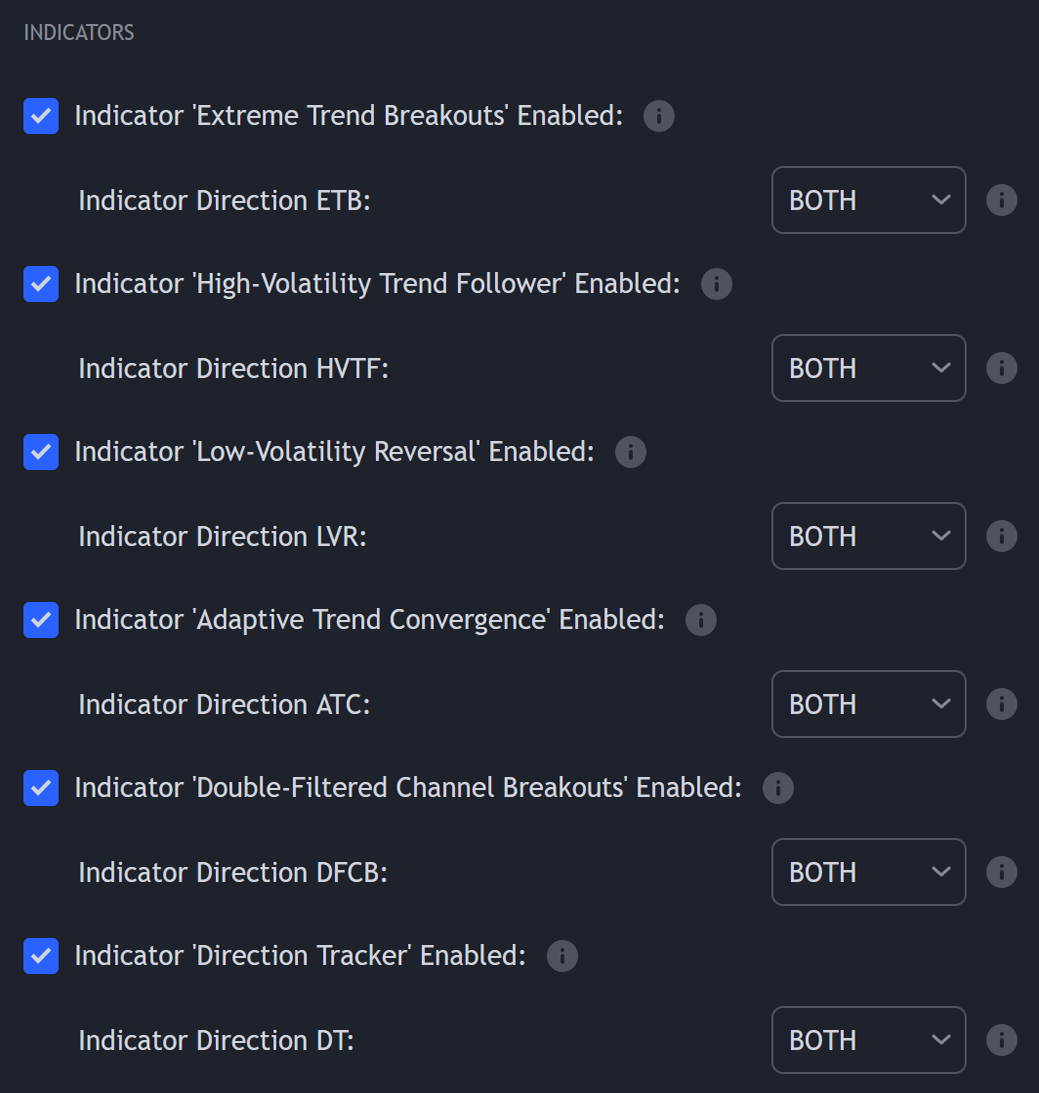

The script, by default, uses all indicators in the suite, but traders can select and combine the indicators they prefer through the parameters section, potentially enhancing safety by using multiple indicators to confirm signals.

A number of adaptive indicators are used. Adaptive means that parameters of the indicators or elements of them are calculated based on recent price movements. These indicators tend to capture trends more quickly and retain their performance over time.

Each indicator can be turned on and off, furthermore it can be set to trade Long/Short or Both individually. By default, all are turned on.

Minimum number of confirmed signals on the same bar can be set, with a maximum of the number of indicators. This allows for signals to be sent only if the minimum confirmations are present. The default is one, and this value can be set for both Long/Short.

Extreme Trend Breakouts

The Extreme Trend Breakouts indicator seeks to follow breakouts of support and resistance levels, while also accounting for the unfortunate fact that market manipulations can happen and false signals can be generated on these levels. The indicator combines trend-breakout strategies with various other volatility and direction measurements. It works best in the beginning of trends.

High-Volatility Trend Follower

The High-Volatility Trend Follower indicator is based around the logic of evading market conditions where volatility is low (choppy markets) and aggressively following confirmed trends. The indicator works best during strong trends, however it has the downside of losing at trend tops or bottoms.

Low-Volatility Reversal

The Low-Volatility Reversal aims at plugging the holes that trend-following indicators ignore. It specifically looks for choppy markets. Using proven concepts such as relative strength and volume measurements, among others, this indicator finds local tops and bottoms with good accuracy. It works best in choppy markets with low to medium volatility. It has a downside that all reversals have, losing trades at the end of choppy markets and in the beginning of big trends.

Adaptive Trend Convergence

The Adaptive Trend Convergence aims at following trends while avoiding entering positions at local bottoms and tops. It does so by comparing a number of adaptive moving averages and looking for convergence among them. Adaptive filtering techniques for avoiding choppy markets are also used.

Double-Filtered Channel Breakouts

The Double-Filtered Channel Breakouts indicator is made out of adaptive channel-identifying indicators. The indicator then follows trends that significantly diverge from the established channels. This aims at following extreme trends, where rapid, continuous movements in either direction occur. This indicator works best in very strong trends and follows them relentlessly. However, these strong trends can end in strong reversals and the indicator can be stopped-out on the last trade.

Direction Tracker

The Direction Tracker indicator is made out of a central slower, adaptive moving average that clearly recognizes global, long-term trends. Combined with direction and range indicators, among others, this indicator excels at finding the long-term trend and ignoring temporary pullbacks in the opposite direction. It works best at the beginning and middle of long and strong trends. It can fail at the end of trends and on very strong historical resistance lines (where sharp reversals are common).

Parameters Menu

1 • Preset Selection

Choose between Bitcoin or Ethereum preset to tailor the indicators to your preferred cryptocurrency market.

This will set parameters to match the market movements of the two currencies.

In order for the script to apply it's preset settings for BTCUSD / ETHUSD it is necessary to change the ticker of the TradingView Chart from the menu on the left.

2 • Global Signal Direction

Set the global signal direction as Long, Short, or Both, depending on your trading strategy.

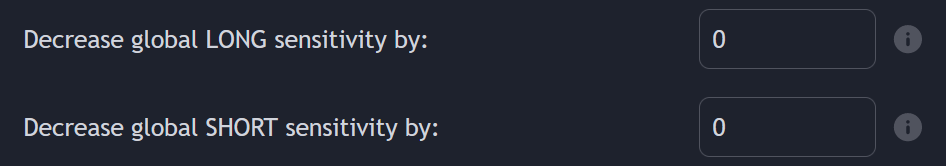

3 • Global Sensitivity Parameter

Lower the sensitivity of the script to adapt trend-following conditions for higher strength trends.

Available for both LONG and SHORT direction separately.

4 • Source of Signals

Indicator Toggle & Trade Direction

Turn individual indicators on or off according to your preference. By default, all indicators are toggled on. Customize the indicators to trade Long, Short, or Both, depending on your desired market exposure. Again, default settings allow signals in both directions.

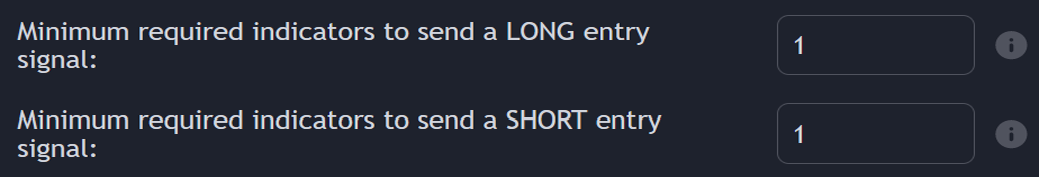

5 • Confirmation of Signals

Minimum Confirmed Signals

Set the minimum number of confirmed signals on the same bar, allowing signals to be sent only when the minimum confirmations are met. The default value is one, and it can be adjusted for both Long and Short signals.

6 • Exit of Signals

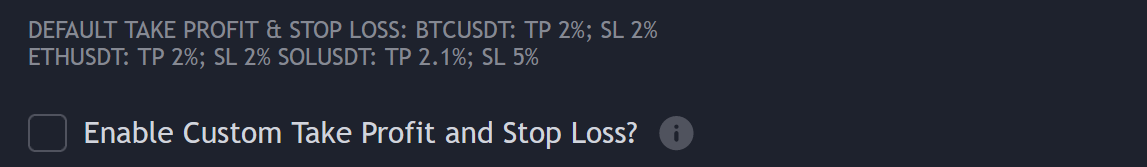

Enable/Disable Custom Take-Profit/Stop-Loss (TP/SL)

By enabling custom TP/SL Levels, the script will exit trades at these levels accordingly. If disabled, the script will use the default TP/SL levels for each trading pair, as noted above the parameter.

You can tweak the TP/SL levels in percentage terms

Traders also have the option to completely turn off TP/SL levels.

By disabling these levels, the script will not look at closing trades on TP/SL. It will enter and exit trades on direction change (example: Long closes Short and vice versa). Disabling Stop-Loss completely can bring additional risk.

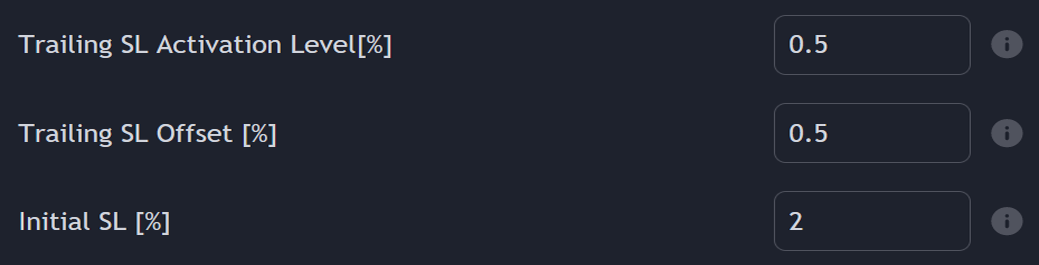

Enable Trailing SL

By enabling Trailing TP/SL the script will switch from pre-set TP/SL levels to a trailing approach.

There are options to:

- Place an initial customizable SL.

- Place a level (%) for the Trailing SL to become active.

- When the activation level is reached, the script will move the trailing stop by a given Offset (%).

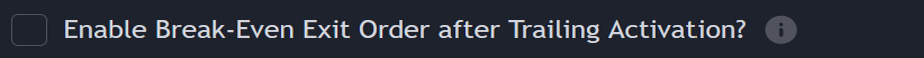

Enable exit at break-even

By enabling exit at break-even, the script will place an exit order when the trail activation level is reached. Keep in mind that this order will include the fees and slippage, so it won't be completely at zero loss!

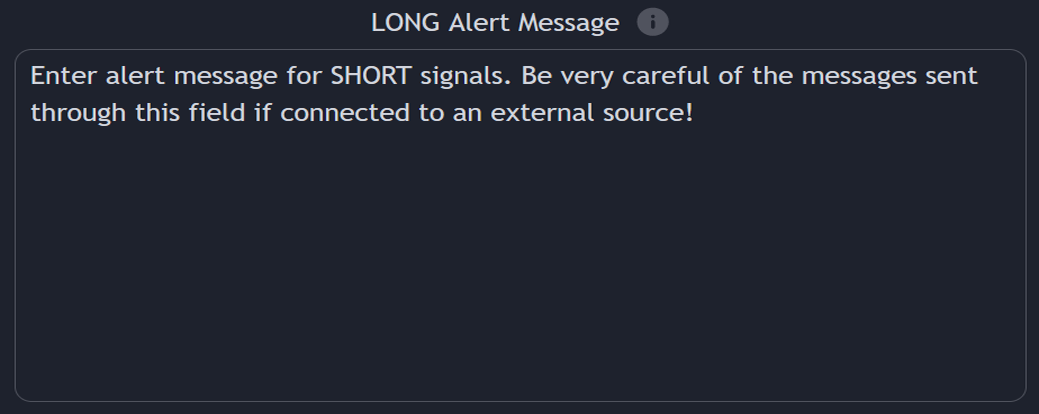

7 • Alert Messages

Alert Conditions

Define the fields for alert messages that will be sent based on specific conditions. You can hook up alerts to receive email, SMS and in-app notifications. Using webhooks, you can connect these alerts and messages to a third-party website.

Be very careful if setting up webhooks for alerts, as the messages contained in the fields can potentially execute trades without human supervision. Again, we recommend that you do not follow signals blindly, but how you trade is a personal choice!

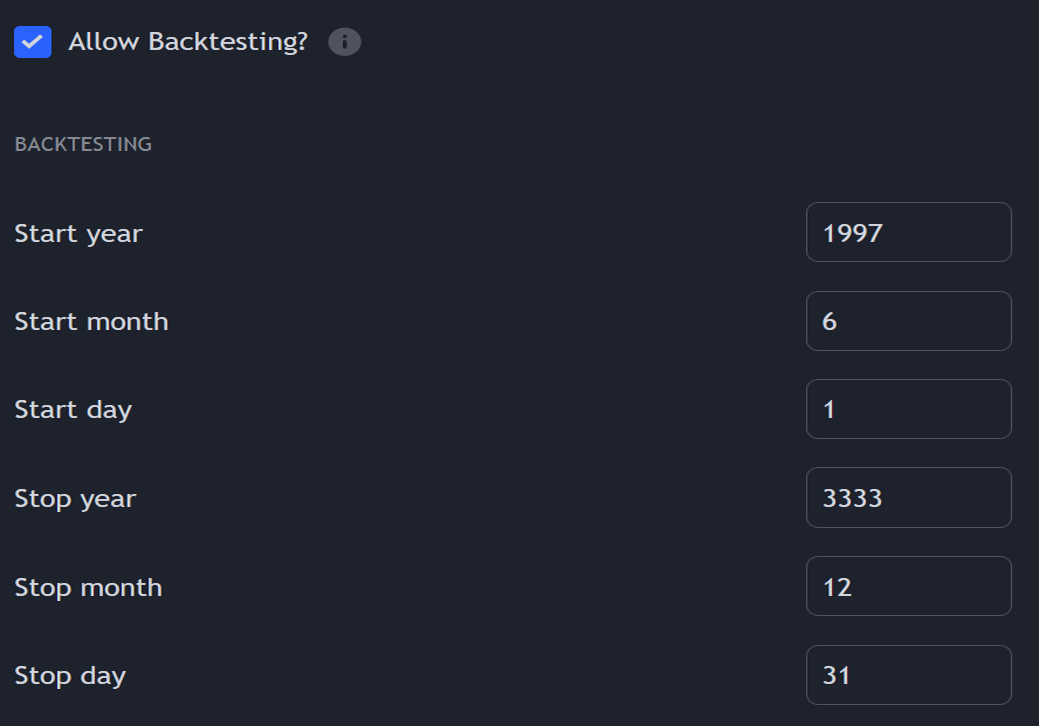

8 • Backtesting

Historical Performance

Adjust the periods for backtesting to analyze the script's historical performance and trades during different timeframes.

You can turn backtesting on and off. This will disable signals all-together.

There are options to:

- Input a start day, month and year.

- Input an end day, month and year

All signals outside of the provided time range will be disregarded when building the historical backtesting report.

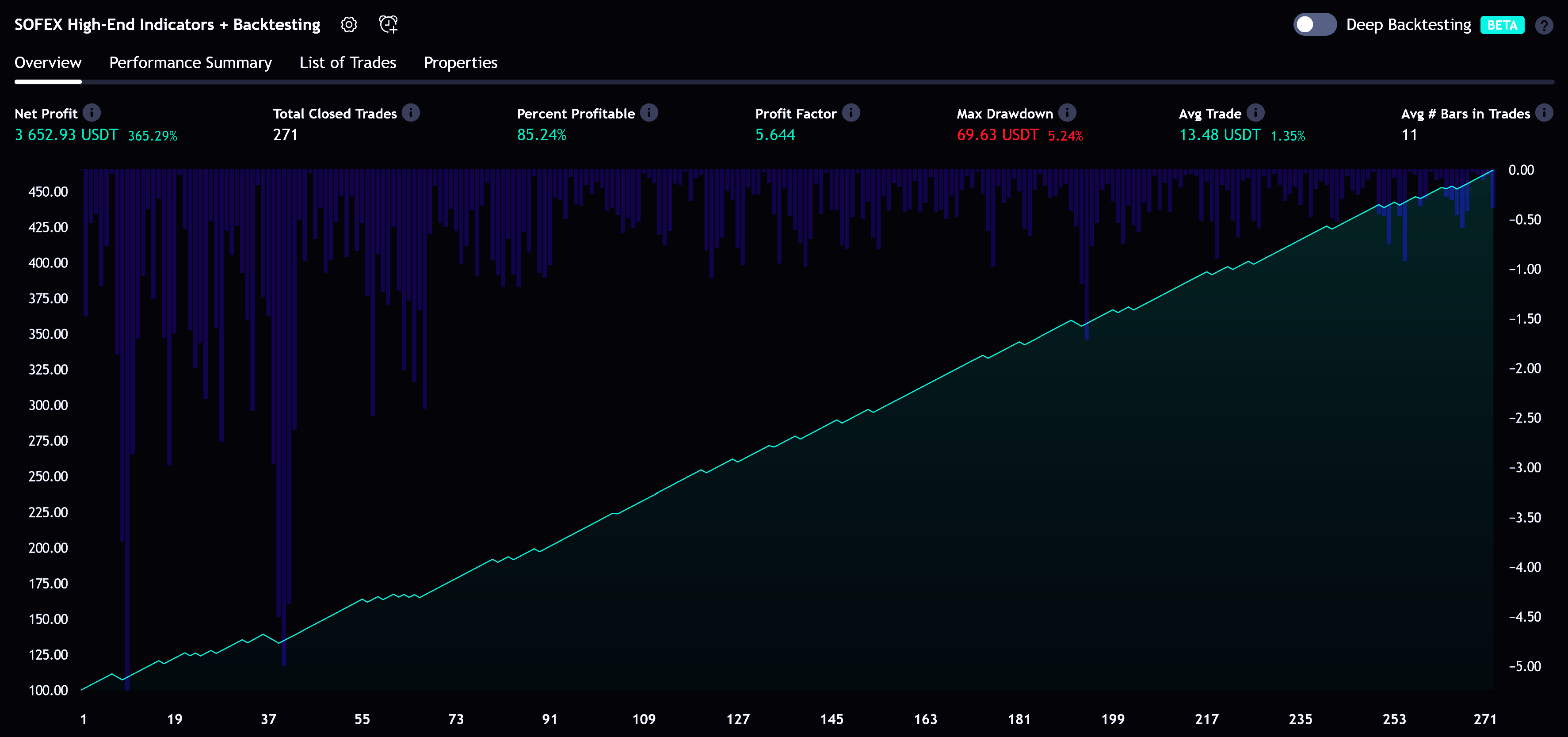

This is an example configuration of the system for BTCUSDT on Binance.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.